ST. LOUIS ŌĆó Missouri Auditor Nicole Galloway is launching a review of the cityŌĆÖs use of economic incentives ŌĆö including tax abatement and tax increment financing ŌĆö as part of her comprehensive audit of ėŻ╠ę╩ėŲĄ.

Galloway , following a request from the Board of Aldermen. Prior to that, a group of activists had urged an audit of the city and were gathering signatures to submit to the state auditorŌĆÖs office, another method of triggering an audit.

While the audit had always envisioned a comprehensive look at ėŻ╠ę╩ėŲĄ operations, Galloway said her meetings with residents over the last few weeks have convinced her to home in early on economic development incentives administered by the ėŻ╠ę╩ėŲĄ Development Corp., or SLDC.

People are also reading…

ŌĆ£I consistently hear concerns about how the city is awarding, broadly, tax incentives and how theyŌĆÖre being managed and monitored by the city,ŌĆØ Galloway said in an interview. ŌĆ£So weŌĆÖll take a thorough and independent examination so we can get answers to those questions.ŌĆØ

, the review of the cityŌĆÖs economic development functions did not delve into all of SLDCŌĆÖs various arms. It was limited to the Community Development Administration, which administers federal block grants; the Land Reutilization Authority, the cityŌĆÖs land bank for abandoned properties; and the Affordable Housing Commission.

Galloway has already begun examining whether recommendations from that audit were carried out. She also is reviewing the cityŌĆÖs Supply Division, which acts as purchasing agency for most of city government.

. Critics say it deprives the cash-strapped city and the school district of potential revenue by giving developers breaks on years of future tax liabilities. They also contend itŌĆÖs difficult to know whether the incentives are really needed for some projects.

Officials at SLDC counter that high construction costs and low rents in ėŻ╠ę╩ėŲĄ compared to other metro areas often make the incentives a necessary part of a developerŌĆÖs financing. They point out incentives use future money that wouldnŌĆÖt have been generated without the project.

, hiring new staff analysts who check developer numbers to help the city better negotiate incentive values. TheyŌĆÖve also begun recommending lower tax abatement amounts so at least some new property tax revenue is generated up front on new construction.

ŌĆ£SLDC welcomes the review by the auditor as we are always looking for improvements in our management and execution of our development incentive program, as evidenced by our commission of a review of the program by a third-party consultant, and by our implementation of most of the recommendations included in the consultantŌĆÖs report and the recommendations from the Board of Aldermen,ŌĆØ SLDC Director Otis Williams said in a statement.

Under new accounting requirements, the city reported that it had not collected nearly $30 million last year due to property tax abatements. Most of that money would have gone to the ėŻ╠ę╩ėŲĄ Public Schools. TIFs, which let developers keep a portion of revenue from new sales and earnings taxes in addition to property taxes, allowed about $400 million to go uncollected from 2000 to 2014, according to a city-commissioned report released two years ago.

The amount of the incentives used in the city has been noted by credit rating agencies that observe it will be years before most of the new revenue from many recent big projects begins flowing into city coffers.

The city agency responsible for reviewing tax break requests is recommending fewer, but some aldermen have ignored them.┬Ā

ŌĆ£Incentives are valuable tools,ŌĆØ Galloway said. ŌĆ£And taxpayers want to make sure theyŌĆÖre getting a return on their investment.ŌĆØ

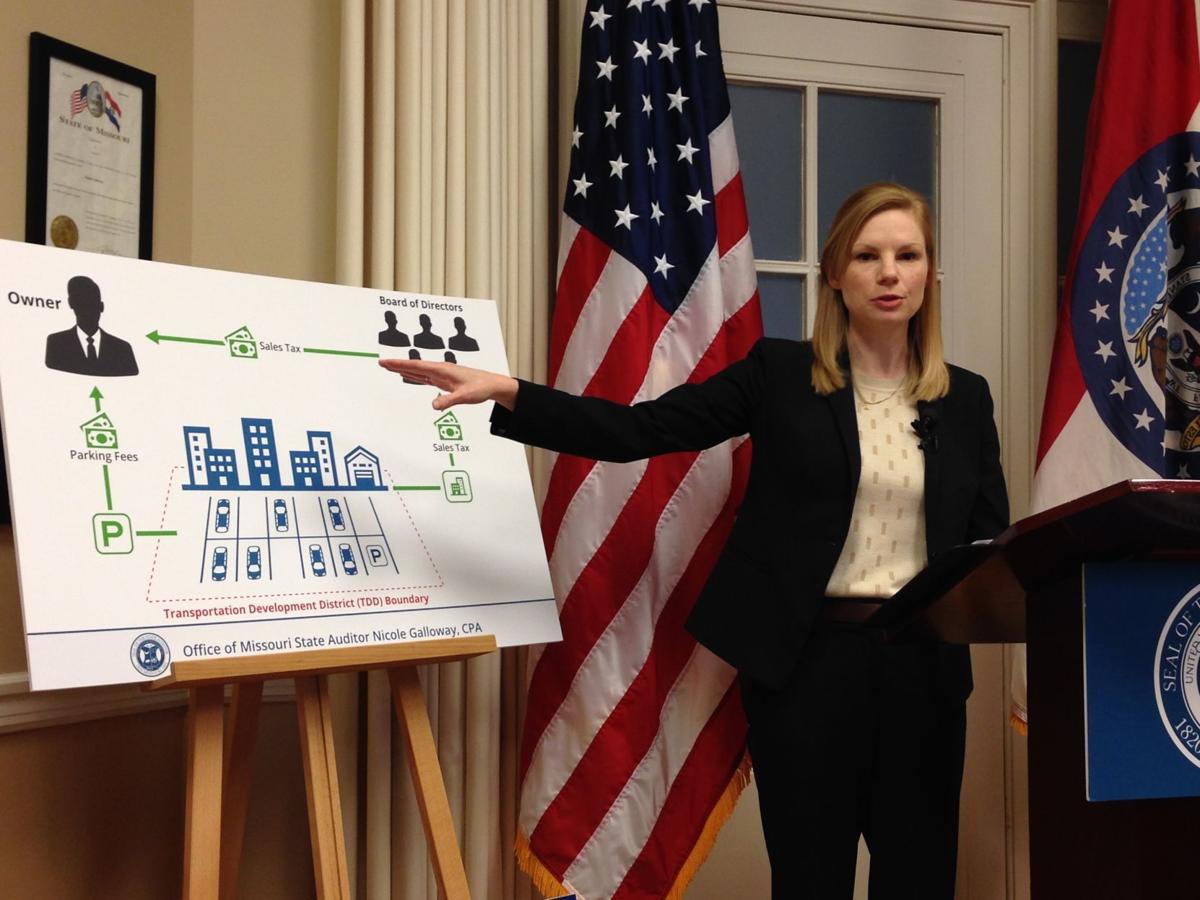

Galloway said her office also will evaluate special taxing districts such as Transportation Development Districts and Community Improvement Districts. Those entities can levy up to a 1 percent sales tax and are ubiquitous in the region. TheyŌĆÖre often administered by developers and layered with TIFs.

ŌĆ£While those are their own special political subdivisions, the city is involved in approving some of those, so we will be looking at the city governmentŌĆÖs role,ŌĆØ Galloway said.

Galloway said the review will focus on transparency, accountability and whether incentives are administered in a fiscally responsible manner.

She expects her review of economic development incentives will touch on city offices beyond the SLDC, including the ėŻ╠ę╩ėŲĄ comptrollerŌĆÖs office because of its role tracking city revenue.

It wonŌĆÖt be a quick project ŌĆö a report on incentives likely wonŌĆÖt be ready until next year.

That will be one of many reports the state auditorŌĆÖs office puts together on different functions of city government as part of its larger audit. The overall audit is expected to take up to three years and cost the city, which is paying for the work, up to $1.75 million.