So far, so (largely) good with the Cardinals’ efforts to increase their television and streaming viewership levels.

The club has been experimenting this year with placing a handful of its locally produced games on over-the-air television after an absence of a decade and a half, and also is making all its local telecasts available for direct purchase via streaming for the first time.

The developments have led to significantly increased viewership and although the rise is not at blockbuster levels, an extreme bump seemed unlikely at a time of fan discontent with the team as evidenced by a significant downturn in home attendance even before the club’s recent slide.

The Cardinals have been using Gray Media-owned KMOV (Channel 4) and/or Matrix Midwest (Channel 32) to supplement their cable telecasts on FanDuel Sports Network, a simulcasting arrangement scheduled to encompass 10 games and perhaps one or two more late in the season depending on how many contests national outlets add for exclusive coverage (ESPN just picked their Aug. 10 home game against the Cubs for “Sunday Night Baseball”).

People are also reading…

Through last week’s All-Star break, seven games had been shown in that package. But only four had been carried on KMOV, which has been on the air for seven decades and has a large following. Those also were shown on Matrix Midwest, which won’t reach its first anniversary for another month and has had miniscule viewership numbers according to audience-measuring firm Nielsen. Because KMOV is a CBS affiliate, it has limited pre-emptions of network programming so the three contests in the deal that it didn’t carry were shown over-the-air only on Matrix (in addition to the cable coverage).

Channel 4’s telecast of its four games were seen in an average of 4.5% of the market, according to Nielsen, but the Matrix figure was a measly 0.2%. It is evident that the over-the-air telecasts cannibalized cable viewership — the FDSN average rating for those contests was 2.8, compared to its season average of 4.2 at the break. But the combined audience for all three channels, 7.5% of the market, is a big increase over the cable-only average and is a figure that few shows attain in this era of significantly declining television viewership.

While that is a major crash from the 12.3 figure KSDK (Channel 5) drew for a series of Sunday afternoon games in 2010, the last time the Cards included over-the-air contests in their broadcasting deals, it is a highly respectable figure in the modern landscape.

���Գܰ����������ܲԲ������ٲԱ�

For example: In 2010, Cards cablecasts drew a 9.5 rating. This year they were as mentioned at 4.2 when play resumed after the break, with viewership having risen each month. Also, the top-rated show nationally for the television season that ended in the spring of 2010 was the Tuesday night version of “American Idol,” at 13.7. Topping the list for the season that ended last spring was “Sunday Night Football,” at 5.3.

Cardinals senior vice president of business operations Anuk Karunaratne said the club is pleased with the results from its return to free TV, at least on KMOV.

“I think it’s been what we would’ve hoped it would be,” he said. “The reason we were doing this was to increase reach, and from all of the information we’ve seen there’s clearly a lift — a significant lift — in viewership on those games.”

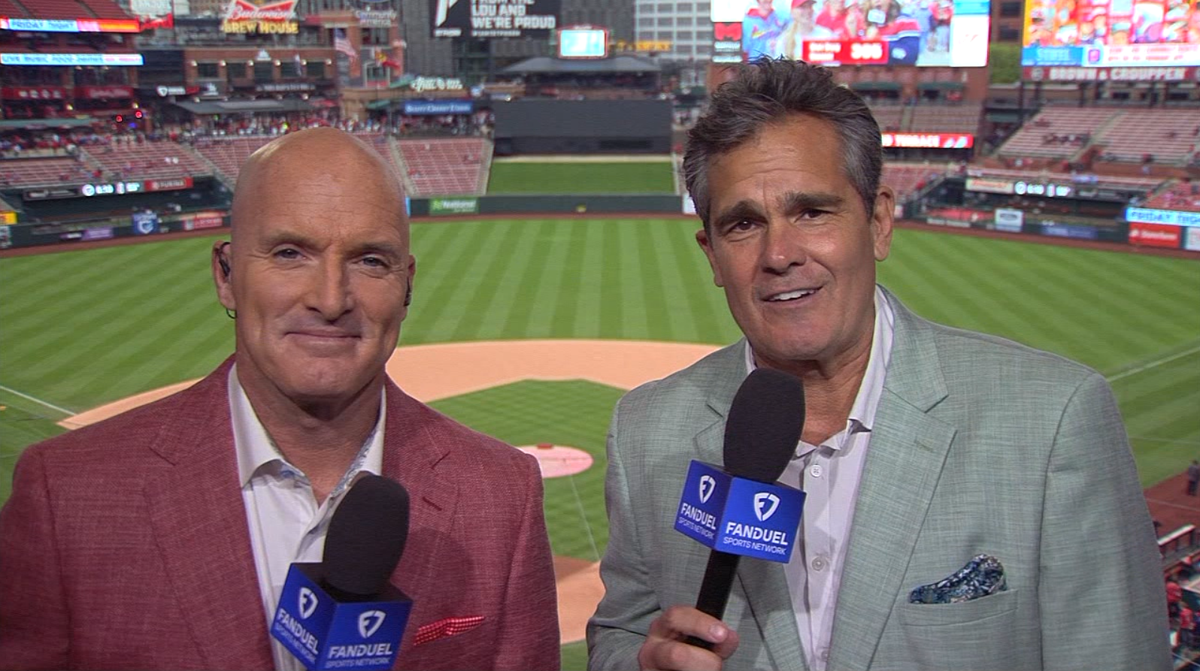

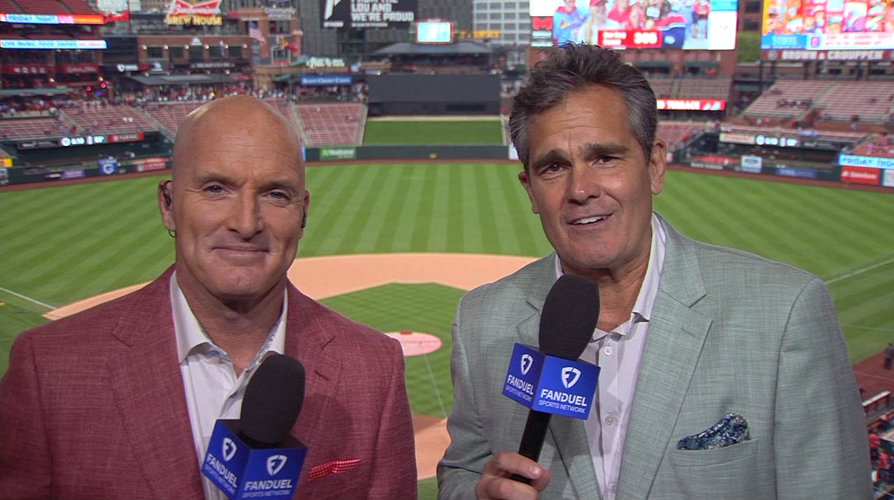

JD Sosnoff

JD Sosnoff, general manager of both local Gray stations, embraces the results.

“I’m thrilled with having the Cardinals, and the response we’ve received from the viewers has been nothing but positive about their ability to access the games,” he said. “I think the biggest benefit is for viewers in the marketplace who now have the ability to watch games if they chose not to pay for a subscription service. ... It’s been a really good thing for the ӣ����Ƶ Cardinals as well.”

An additional aspect of the return to free TV is that the contests Gray is showing in ӣ����Ƶ also are available over the air in more than a dozen outlying markets across the Cardinals’ broadcast territory (mostly on Gray stations) in addition to appearing on cable.

“We’ve been really happy with that,” Karunaratne added. “We’ve gotten a lot of positive feedback from viewers who said they’re really glad to have that as an option.”

Karunaratne estimated that about as many people are watching the over-the-air telecasts outside of ӣ����Ƶ as in the market.

“That’s been really positive,” he said.

Sosnoff said he did not yet have exact market-by-market viewership figures in the hinterlands but said reaction has been strong.

“The Gray stations in the region are ecstatic about being able to offer that in their communities,” he said.

Matrix malaise

One definitive conclusion can be drawn from the Cards’ over-the-air test, and is backed by similar results for the Blues: According to Nielsen’s figures, Matrix Midwest simply isn’t ready to be a standalone over-the-air option for the major local teams.

The Blues also experimented with the Gray channels this year, the first time in 16 seasons they had over-the-air television in their local broadcast lineup, and are considering more such telecasts for the coming season. It was a small sample size last spring, just three games, and unlike the Cardinals they did not simulcast them on cable. KMOV aired two of the three contests in the package and averaged a 4.4 rating (compared to the season-long cable average of 2.5). Matrix had one to itself, which drew just 1% of the market, and when both stations had the telecasts that Matrix numbers were microscopic 0.2 and 0.1.

With the Cardinals, Matrix as mentioned averaged just 0.4% of the market when it shared games with KMOV and the cable station. That rose to just 0.5% when Matrix was the only free TV option, a miserable showing. Things have been so dismal that Nielsen reports Matrix had a 0.03 rating (less that 0.1% of the market watching, which rounds to a 0 rating) for the game against the Los Angeles Dodgers on June 6 it shared with the other channels. Nielsen’s figures say that in one 15-minute segment of the telecast, 46,488 people were watching on cable, 45,742 on KMOV and 104 on Matrix.

Sosnoff, the GM of the local Gray stations, has taken exception before with the Nielsen figures and said that another service he uses has higher numbers for Matrix’s games. But Nielsen remains the industry standard and its Matrix ratings are extremely low despite the station continuing to add sports content in its effort to transition from showing mostly old TV shows to becoming a destination for athletics-oriented material, the most high profile being these Cardinals and Blues live games.

“If it works out, I think it will be just good for our region in general to have more dedicated sports programming,” Karunaratne said. “That’s part of the reason why we did it, and it takes time to build equity in that.”

But the Nielsen numbers say Matrix remains unfamiliar — or unknown — to many despite it being widely available, so time could be short for it to prove it’s a viable sole over-the-air option.

“What seems nondebatable is (viewership) it is significantly lower when it’s just on Matrix,” he said. “So that’s not helping us achieve our goal, which is more reach. ... In the long run we would like to see those numbers come up for it to make sense for those games to just be on Matrix.”

Cards direct streaming

Another key component of the Cardinals’ strategy in trying to gain exposure throughout their geographic broadcast territory is to sell the telecasts directly to fans via streaming, something the Blues have done for the past three seasons before the Cards began doing so this year. Previously, a subscription to a program distributor that carried the team’s cable network was required to stream the telecasts.

FanDuel Sports Network said that through the All-Star break more than 131,000 separate customers have watched at least part of one game through the app. That’s a 238% increase over the same point last year, with a peak of 51,000 streamers for a contest June 3 against Kansas City. However, the company is not releasing the average number of streamers per game. The figures include viewers throughout the region, not just in the ӣ����Ƶ area.

“It is a significant number in relation to the number of people that are watching on TV,” the Cardinals’ Karunaratne said of the streaming figures while emphasizing the importance of the entire region, not just the immediate area, to the club. “That’s been really positive.”

A free month of the streaming coverage is being offered for new customers who pay for a month of service by registering at then using the code CardsBOGO at checkout. The deal runs through the end of July.

The bottom line

The Cardinals’ TV and streaming moves have combined to help the club attain a goal. While the cable viewership rating is unchanged for the same point last year, the increase with streaming plus the addition of over-the-air games has created an overall audience rise.

“We wanted to make a significant impact on reach,” Karunaratne said. “Our approach to doing that was to create more options for people to be able to access the games, and we’ve seen really good uptake on both of those (options). As we think about next season, we’ll keep thinking about ways we can continue enhanced that. And hopefully grow those numbers.”

He said the plan is for the direct-purchase option for streaming to return next season and added that while a “final decision” hasn’t been made about incorporating free TV into the local broadcast lineup then, “that is something we would like to continue.”

Cardinals TV ratings comparisons

| DATE | OPPONENT | KMOV (4) | MATRIX (32) | FDSN |

|---|---|---|---|---|

| April 11 | vs. Philadelphia | 6.3 | 0.2 | 2.5 |

| April 25 | vs. Milwaukee | --- | 0.6 | 3.2 |

| May 16 | at Kansas City | --- | 0.7 | 4.5 |

| May 30 | at Texas | 3.7 | 0.2 | 2.0 |

| June 6 | vs. LA Dodgers | 3.6 | 0.0 | 3.1 |

| June 20 | vs. Cincinnati | --- | 0.4 | 4.2 |

| July 11 | vs. Atlanta | 4.4 | 0.4 | 3.4 |

| Average | 4.5 | 0.4 | 3.3 | |

Post-Dispatch baseball writer Derrick Goold joined columnist Jeff Gordon to discuss a possible sell-off with the team fading from the playoff race.